As a director of research and an investment advisor, writing quarterly commentaries can sometimes be a difficult task. There are only so many ways to say that large U.S. technology companies continue to lead the market. Investors should focus on diversification because we invest for the future—not just what worked yesterday. For the past few years, I have approached the fourth-quarter Capital Market Review as an opportunity to step back and reflect on the year, usually during one of the quietest weeks of the year between Christmas and New Year. Some years, Western Pennsylvania is fortunate enough (or unfortunate, depending on your point of view) to have snow, allowing me to spend part of that week skiing—a great place to think and clear my mind for a new year.

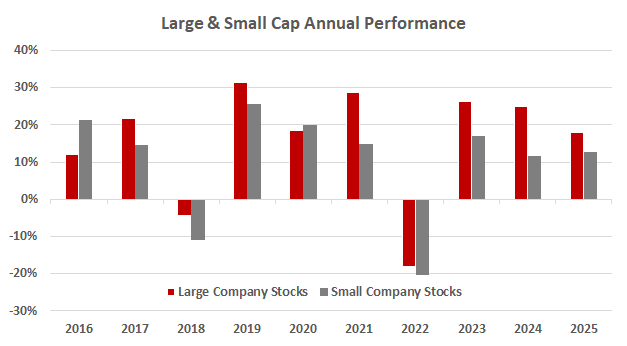

Last year marked the third consecutive year of double-digit gains from the S&P 500 Index, which ended the year up nearly 18%. Over the past decade, the U.S. stock market has been on an impressive run. Over the past 10 years, eight of them finished positive, and all saw returns climb by double digits; five years ended more than 20% higher.

It’s tough for a diversified portfolio to keep up when one part of the market dominates. Small-cap stocks, tracked by the Russell 2000 Index, felt like a challenging place to invest last year. While they have lagged the S&P 500, small caps still posted double-digit gains in eight of the last ten years. The frustration from the last year or two has been much of that performance was generated by lower-quality, money-losing companies. Investors should avoid businesses with that profile, so it can feel like portfolios are sitting on the sidelines when those names lead. The chart below shows the gap between profitable and unprofitable companies—a split that’s been clear since the pandemic. When markets were down in 2022, investors wanted to own profitable companies that hold up better when markets are uncertain. But then there are periods like the past year, when money-losing companies are the top performers. I believe this trend won’t last forever. Patience matters, and I expect a shift back toward quality over time.

partial rotation that investors experienced in 2025 was that the Magnificent Seven did not dominate returns to the same extent as prior years. Yes, the group continued to outperform the S&P 500 Index, driven by Alphabet and Nvidia. If not for those two companies, the returns of that basket of companies would have been mediocre, at best. AI remained a dominant theme, just expanded beyond the seven companies investors had become accustomed to benefiting. Now, markets are looking to industries that will benefit from AI technology, such as industrials, financials, and health care, as well as to areas of the AI supply chain. For instance, utility and energy companies will be needed to generate power, and the construction of data centers will be needed for AI’s expansion.

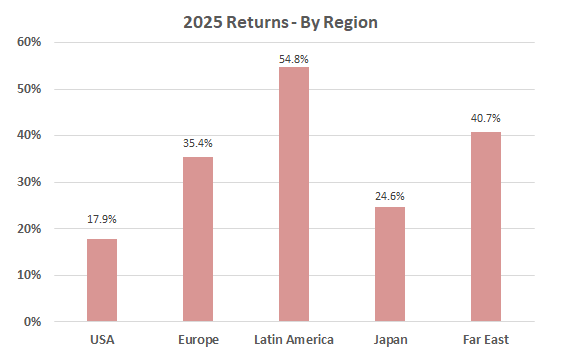

One rotation investors did see in 2025 was the long-awaited outperformance of international stocks. While the S&P 500 returned 18%, international markets did even better—up more than 30%. This is why maintaining global allocations, even when they’re out of favor for years, can be beneficial for a portfolio.

Contrary to what many thought a year ago, the America First agenda of the current administration has forced foreign countries and companies to invest in themselves rather than rely on the U.S. for defense and other fiscal needs. The dollar’s weakening provided a strong boost for foreign markets, but there does seem to be a more lasting trend forming as well.

Looking Ahead

One of the most common questions I receive is what markets are going to do over the next year. This is the time of year when many financial firms post their predictions about what they believe will happen over the next 12 months. The problem with this is that market outlooks fall into three categories. The permabulls, who always have a positive outlook; the permabears, who call for a recession every year; and the remainder, who predict a continuation of the prior year. Occasionally, an outlook will break the trend with an out-of-consensus call. Then, an event on no one’s bingo card occurs, recency bias continues to take hold, and outlooks are changed to incorporate the new information.

There are the known risks of 2026: mid-term elections, tariffs, inflation, and the labor market, to name a few. Just three days into the new year, we experienced a geopolitical event in Venezuela – proving the only certainty in investing is uncertainty. Known risks are hard enough to account for; the unknown risks make it nearly impossible to constantly adjust portfolios for near-term events.

Rather than attempting to take all this information from outlooks and analyze how possible risks may or may not impact portfolios, investors should continue to stick with the time-tested process of investing over the long term, even when portfolios are out of sync with markets, to help keep us on track for long-term success. I like to compare it to skiing down a mountain; everything is going smoothly until that patch of ice surprises you out of nowhere and makes you feel out of control. At that moment, instincts and training take over – you keep the knees and waist bent and shins into the front of your boots Investors can take this same approach when market events make it seem like portfolios are out of control; focus on the core features that have worked numerous times in the past, and rely on them to get you back in control.