In this digital world where credit monitoring websites, credit card companies, and banks all offer free credit scores, you can receive your credit score with just a few clicks. Have you ever noticed your credit score may differ by source? The score you see on a credit monitoring website such as Credit Karma may differ from the credit score your bank provides, and both of those scores may be different from the credit score your credit card lists. Why is this, and does it matter?

What is a Credit Score?

Lenders use credit scores to evaluate the creditworthiness of borrowers. Lenders look at historical data to estimate borrowers’ probability of making payments on time or defaulting on a loan.

The three credit reporting bureaus (Experian, Equifax, and TransUnion) all collect credit data on you. The credit information is used to calculate your credit score, but the three credit reporting bureaus do not calculate the credit score themselves. Your credit score is calculated by several companies using scoring models. The most well-known scoring models are FICO and VantageScore. How these companies calculate your credit score differs, and their scoring models are always changing. Currently, the most used FICO scoring model is FICO 8, and the most widely used VantageScore is model 3.0. For our purposes, we’ll focus on these two scoring models.

How does the FICO 8 Scoring Model Work?

The FICO 8 scoring model uses five categories to calculate your credit score. Each category is weighted on a percentage basis.

- Payment history: 35%

- Payment history is a record of how you have paid your accounts over time.

- Credit Utilization: 30%

- Credit utilization is calculated by dividing your total credit card balances by your aggregate credit card limits. The lower your utilization, the better.

- Length of credit history: 15%

- FICO analyzes three credit information factors when looking at your credit history.

- How long your credit accounts have been open, including the age of your oldest account, the age of your newest account, and the average age of all your accounts.

- How long specific credit accounts have been open.

- How long it has been since the account has been used.

- FICO analyzes three credit information factors when looking at your credit history.

- New credit: 10%

- FICO looks at how many new credit accounts you have opened in the last 12 months. Opening frequent credit accounts may be viewed as a greater risk to lenders.

- Credit mix: 10%

- Lenders like to know you have successfully managed different types of credit.

How Does the VantageScore 3.0 Scoring Model Work?

VantageScore 3.0 scoring model uses six categories to calculate your credit score. VantageScore’s categories are also weighed on a percentage basis.

- Payment history: about 40%

- Like FICO 8, VantageScore 3.0 wants to see that you are consistently making on-time credit account payments.

- Age and type of credit utilization: about 21%

- Lenders like to see that you have used different credit types over a long period of time.

- Percentage of credit limit used: about 20%

- Like FICO 8, VantageScore 3.0 likes to see lower available credit utilized.

- Total balances and debt: about 11%

- Total balances refer to the current debt amounts recently reported on your credit reports. Future lenders like to see lower debt balances as it shows your ability to pay down debt.

- Recent credit behavior and inquiries: about 5%

- Lenders like to know if you have suddenly needed additional credit—and how often.

- Available credit: about 3%

- Lenders like to see that you are not maxing out all available credit—and only take what you need.

Can My Credit Score Vary Using the Same Scoring Model?

Yes, your credit score may vary even if the same scoring model is used. This is because lenders are required to report credit data to any one of the three credit reporting bureaus. Lenders are not required to provide data to all three credit bureaus. Reporting to one credit reporting bureau is more common with local credit unions as it costs lenders money to report your credit information.

Your credit score also may vary depending on when lenders provide information to the credit bureaus. If there is a lag in reported credit information, your credit score may be slightly different.

Why Don’t Lenders Use One Scoring Model?

Every lender has different needs and varying appetites for risk. The risks of a bank issuing a three-year auto loan versus the same bank writing a thirty-year mortgage are different, and different scoring models may be used to assess those risks.

What is Considered a Good Credit Score?

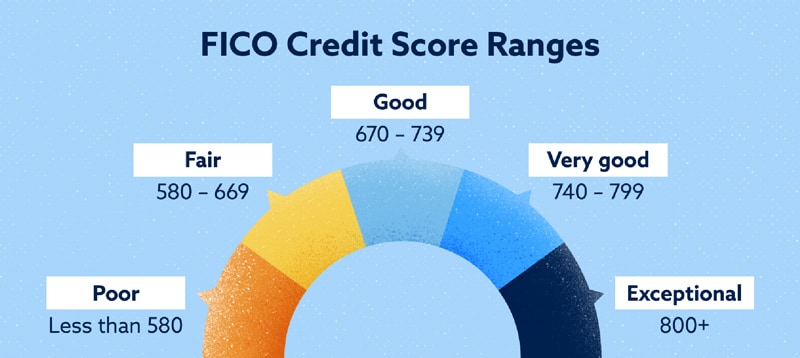

FICO 8 and VantageScore 3.0 both use scoring models that range from 300 to 850

FICO 8

| Rating | Score |

| Poor | 300 – 579 |

| Fair | 580 – 669 |

| Good | 670 – 739 |

| Very Good | 740 – 799 |

| Exceptional | 800 – 850 |

Vantage Score 3.0

| Rating | Score |

| Poor | 300 – 600 |

| Fair | 601 – 660 |

| Good | 661 – 780 |

| Exceptional | 781 – 850 |

Changes to Medical Collection Debt Reporting

As of July 1st, 2022, Equifax, Experian, and TransUnion agreed to change how they view and report medical debt.

The three credit reporting bureaus agreed they would no longer include medical debt on your credit report that was paid after it was sent to collections. Additionally, any unpaid medical debt in collections for twelve months will now be reported on credit reports; the standard was previously six months.

Starting in 2023, all three credit bureaus will only report medical collection debt over $500.

The credit bureaus estimate that roughly 70% of medical collection debt will be removed from credit reports.

How Do I Check My Credit Report?

The Fair Credit Reporting Act (FCRA) requires all three credit reporting bureaus — Equifax, Experian, and TransUnion — to make available at your request a free copy of your credit report. The three credit reporting bureaus are required by the terms of the Fair Credit Reporting Act to provide this free credit report once every 12 months.

You can get your credit report by following the links below:

When checking your credit report, it is important to look for inaccuracies—and dispute any you may find.

Common credit report inaccuracies may include:

- Accounts you never opened or closed may show on your credit report due to identity theft or a clerical error by the reporting bureau.

- An account may be inaccurately reported as late or delinquent.

- Balances, names, addresses, and phone numbers may be reported incorrectly.

How Do I Dispute a Credit Report Error?

You can file a dispute to correct an error on your credit report online or by mail. Every credit bureau has a similar but different process to file a dispute.

You will need to provide supporting documents to prove who you are (IDs, Social Security Number, utility bill), information about the believed error (account numbers, statements, payment history, a letter explaining the dispute), and other information.

You can find more information at the links below:

How Can I Improve My Credit Score?

- Making on-time debt payments is crucial factor in your credit score. Always pay your bills in full and on time. If you are unable to make a full payment, it is better to make the minimum payment versus no payment at all.

- Experts recommend keeping your credit utilization ratio below 30%.

- Try not to close old credit cards unless you must. Closing your oldest credit card may negatively affect your length of credit history. Doing so may also increase your credit utilization ratio, which may also negatively impact your credit score.

- Increasing your credit limit. If you receive an increase in your pay or your credit history length goes up, you may qualify for a larger credit limit. A larger credit limit is beneficial for keeping your credit utilization ratio low.

- Limiting hard inquiries on your credit report as they may have a negative impact on your credit score. Getting pre-approved with a soft inquiry does not impact your credit score.

- If you or your child are trying to build or improve your credit, you may want to obtain a secured credit card. You pay cash upfront to secure your credit limit, which is normally equal to the deposit amount. A secured credit card is used as a regular credit card, and you will make on-time monthly payments. A secured credit card is unlike a debit card in that you are securing your line of credit with a pre-payment, whereas with a debit card, you are drawing down your deposits.

- If you would like to help jumpstart your child’s credit score, consider adding them as an authorized user on your credit card. This will develop a credit history for them. You do not need to give them a credit card or even let them know the credit card number.

- It should be noted that adding an authorized user has risks as any charges made by them are ultimately your responsibility.

- Also, if you incur negative marks on your credit report, it may impact your child’s credit report as well.

- If you or your child are trying to qualify for a loan but do not have a long credit history, finding a lender that uses the VantageScore scoring model may help speed up the process. VantageScore only needs one month of credit history with one credit account reported within the last 24 months to calculate a credit score. In contrast, FICO needs six months of credit history with one account reported over the previous six months.

As lenders begin to use updated credit scoring models over time, you may see a change in your credit score. It is essential that you routinely check and monitor your credit. Knowing which scoring model your lender uses may help you determine whether your application is more likely to be accepted or declined and what rate you may receive.