Trick or Triage: Surviving Financial Scares with a Solid Reserve Strategy

It’s that time of year when we lean into the thrill of fear—haunted houses, hayrides, scary movies, and spooky decorations fill our calendars and neighborhoods. But for many Americans, the real fright isn’t found in the dark – it’s hiding in their finances.

According to Fidelity’s 2025 New Year’s Financial Resolution study, the top financial fear this year is unexpected expenses. Whether it’s a surprise car repair, a broken appliance, or an unforeseen medical bill, these curveballs can quickly derail even a well-structured financial plan.

This fear isn’t unfounded. Kristen Andrews of Fidelity notes, “This stress is understandable when one considers the fact that nearly 3-in-4 Americans (72%) report experiencing a financial setback this year.”

Spending shocks like these are more common than most realize. On average, working individuals face an unexpected expense every three months—while income typically increases only once a year. With the cost of living continuing to rise, these disruptions hit harder and last longer, especially when discretionary income is already stretched thin.

According to JP Morgan’s Guide to Retirement, monthly spending has increased by 25% year-over-year, forcing many to make difficult tradeoffs:

- Nearly half (48%) turned to credit card debt

- 17% took out personal loans

- 13% reduced their contributions to savings or retirement accounts

These statistics highlight a growing challenge for high-income earners and families alike: how to stay financially resilient when life gets unpredictable. Building a strong emergency fund strategy is one of the most effective ways to reduce that fear and prepare for whatever comes next.

Building Your Safety Net

So how do you protect yourself from these financial frights? It starts with building a strong financial foundation—your emergency fund.

A well-structured financial reserve strategy helps you absorb unexpected expenses without derailing your long-term goals. Think of your emergency fund like Van Helsing—ready to jump in and slay the financial vampires (like surprise medical bills or car repairs) before they drain your resources.

How Much Should You Save?

While the exact amount depends on your personal situation, a good emergency savings rule of thumb is to keep three to six months’ worth of living expenses in a highly liquid, low-risk account.

- Single-income or variable income households: aim for six months of reserves.

- Dual-income or stable income households: three months is often sufficient.

Beyond the Basics: Short-Term Goals and Opportunities Funds

Once your emergency fund is in place, the next step is to plan for short-term financial goals—expenses you anticipate within the next one to two years. This might include:

- A wedding

- Home renovation

- Upcoming education costs

And finally, consider an opportunity fund – a dedicated bucket that gives you the flexibility to say “yes” to life. This could mean joining friends on a spontaneous trip, a friend’s destination wedding, or capitalizing on a limited-time investment opportunity.

Depending on your timeline and risk tolerance, this fund doesn’t have to sit entirely in cash. A conservatively allocated investment account can help your money work a little harder while still maintaining access when needed.

A Real-Life Example: How a Reserve Strategy Works

Let’s look at how this plays out in real life.

Meet Rob, a 35-year-old civil engineer, who earns a steady paycheck every two weeks and spends about $7,000 per month. Based on his lifestyle and income stability, a three-month emergency reserve—or $21,000—is appropriate.

Rob is also planning a wedding in seven months. With half of the $25,000 cost covered by his fiancé, he’ll need $12,500 in accessible funds for his share.

On top of that, Rob’s brother is getting married, and as the best man, he’s budgeted for a Vegas bachelor party. All in Rob estimates he’ll need $35,000 in total savings to feel comfortable covering his goals.

But what if he only had $25,000 or less? Would he be in trouble?

Not necessarily. Financial planning is about balance, not perfection. If Rob needed to dip into his emergency fund temporarily, that’s okay—especially given his stable income and ability to replenish the reserve quickly. The key is knowing what each dollar is earmarked for and having a plan to rebuild when needed.

This example demonstrates the value of a flexible financial reserve strategy. One that adapts to your cash flow, upcoming goals, and comfort level.

Buckets in Practice: How to Organize Your Savings for Stability and Growth

A bucket strategy is an easy way to visualize how your money can work towards multiple goals at once while balancing stability, access, and growth. Here’s how it works:

- Emergency Reserve Bucket

- Purpose: Cover unexpected expenses or income disruptions without relying on high-interest debt.

- Time Horizon: Immediate (0–12 months).

- Examples: Medical emergencies, job loss, car/home repairs.

- Investment Type: Highly liquid and low-risk, such as savings accounts or money market funds.

- Goal: Stability and quick access.

- Short-Term Goals Bucket

- Purpose: Fund planned expenses within the next 1–5 years.

- Time Horizon: Near-term (1–5 years).

- Examples: Buying a car, home renovations, vacations, tuition payments.

- Investment Type: Conservative, like short-term bonds, CDs, and high-yield savings.

- Goal: Preserve capital while earning modest returns.

- Opportunity Bucket

- Purpose: Capture unplanned but positive financial opportunities – the things you want to say yes to.

- Time Horizon: Typically, 1–5 years.

- Examples: Spontaneous trip, investment opportunity, supporting a meaningful cause.

- Investment Type: Moderate, likely income-focused with opportunity for growth.

- Goal: Growth and income

Why the Bucket System Works

This approach organizes your money by purpose and timeline, not just by the account type. That means when life throws a curveball -or a golden opportunity – you’ll already know which ‘bucket’ to draw from without derailing your financial plan.

Starting from Scratch: How to Build a Strong Financial Foundation

If you’re just beginning your financial journey—or rebuilding after a setback—you don’t need to tackle everything at once. The key is to prioritize, stay consistent, and build momentum over time.

Here’s a simple step-by-step guide to strengthen your financial foundation and improve long-term financial stability:

- Build a $1,000 Safety Net

- Start by setting aside $1,000 in cash reserves to cover small, unexpected expenses like car repairs or medical bills, without resorting to high-interest credit cards.

- Capture Free Employer Money

- If your employer offers a retirement plan with a match, contribute enough to receive the full match. It’s one of the few places in finance where you get an immediate 100% return—don’t leave it on the table.

- Open a Health Savings Account (HSA)

- If available through your employer, HSAs can be one of the most tax-efficient savings strategies available. HSAs offer a triple tax benefit:

- Contributions are tax-deductible.

- Growth is tax-free.

- Withdrawals are tax-free when used for qualified medical expenses.

- If you can afford to pay medical bills out of pocket, you can invest your HSA for the future – either family expenses or retirement healthcare expenses that are a near-guarantee.

- If available through your employer, HSAs can be one of the most tax-efficient savings strategies available. HSAs offer a triple tax benefit:

- Tackle High-Interest Debt

- Focus first on debts with double-digit interest rates.

- Snowball Method: Pay off the smallest balance first, then roll those payments forward to the next lowest, etc.

- Avalanche method: Focus on the highest interest rate first for maximum savings.

- Focus first on debts with double-digit interest rates.

- Fully Fund Your Emergency Reserve

- Build out a 3-6 month emergency fund, tailored to your household’s income stability.

- Diversify with Roth Contributions

- If eligible, contribute to a Roth IRA or split contributions between a Roth and pre-tax accounts to improve long-term tax diversification.

- Pre-tax assets (Traditional IRA, 401(k)): reduce taxable income now.

- Roth assets: grow tax-free and provide tax-free withdrawals in retirement.

- This combination gives you flexibility to manage income and taxes later in life, reducing the impact on Social Security, Medicare premiums, and even support legacy planning.

- If eligible, contribute to a Roth IRA or split contributions between a Roth and pre-tax accounts to improve long-term tax diversification.

- Pay Down Lower-Interest Debt Strategically

- Loans like mortgages, student loans, or car loans can be considered productive debt if managed wisely. If your mortgage rate is 3% and your investments can earn 6–8%, you’re effectively “making” more than you’re spending on interest. Plus, mortgage interest may be tax-deductible, depending on your situation

- Invest in a Taxable Brokerage Account

- Once your emergency fund and retirement goals are in place, consider a brokerage account for non-retirement goals—like home renovations or milestone events.

- It offers flexibility, liquidity, and access to a wide range of investments.

Why This Step-by-Step Approach Works

Each step builds on the last, creating momentum and confidence along the way. By starting small and working upward, you’ll strengthen your financial foundation, reduce stress, and gain the flexibility to enjoy life’s opportunities.

Planning for Peace of Mind in Retirement (and Beyond)

While working professionals can rely on a steady paycheck to rebuild savings after a financial shock, retirees face a different challenge: no regular income stream. That makes retirement liquidity planning and wealth preservation more critical than ever.

Even for high-income earners approaching retirement, the shift from accumulation to distribution requires a new mindset: one focused on stability, access, and protection.

The Rising Cost of Retirement

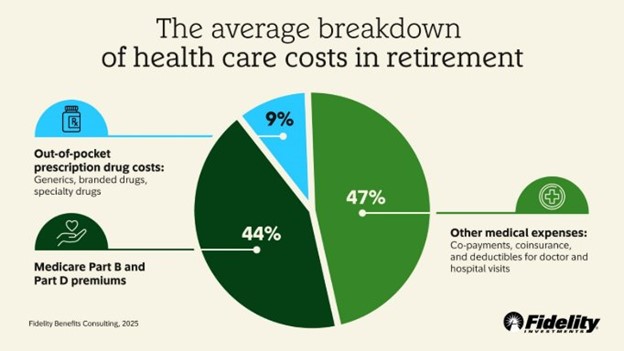

Retirees today face more frequent costly spending shocks, especially related to healthcare. According to Fidelity’s 2025 Retiree Health Care Cost Estimate, a 65-year-old retiring this year can expect to spend an average of $172,500 on medical expenses throughout retirement.

That’s a significant figure—and one that should be built into a long-term financial plan.

A Three-Bucket Approach for Retirement Stability

Just like working individuals, retirees benefit from a bucket strategy—but with a stronger emphasis on preservation, liquidity, and market protection.

Emergency Reserve: Keep six months of living expenses in cash or cash equivalents. This cushion helps cover medical bills, home repairs, or other surprises without needing to sell investments during a market downturn.

Short-Term Liquidity: Maintain 3–5 years of living expenses in conservative investments such as bonds or stable value funds. This ensures access to cash during bear markets—historically occurring about every 3.5 years and taking around 2.5 years to recover.

Opportunity Fund: Even in retirement, life brings joyful surprises—family vacations, weddings, charitable giving, or helping grandchildren with education. Keep a growth-oriented portion of your portfolio to fund these opportunities while preserving your standard of living.

Why it Works

This layered approach mirrors the strategy used by working individuals—but with a sharper focus on predictability over performance. It’s not just about having enough money—it’s about having the right money in the right place when you need it.

Final Thoughts: Don’t Let Financial Fears Haunt You

Whether you’re navigating the early stages of your financial journey, managing multiple priorities, or approaching retirement, one truth remains: unexpected expenses are inevitable—but financial stress doesn’t have to be.

By creating a layered reserve strategy—starting with an emergency fund, expanding into short-term and opportunity buckets, and incorporating tax diversification and investment flexibility—you build a plan that’s resilient, adaptable, and aligned with your goals.

For retirees and pre-retirees, this structure is even more essential. Without a regular paycheck, having liquidity and protection from market volatility is key to maintaining financial confidence and peace of mind.

But regardless of your stage in life, financial planning isn’t about perfection—it’s about preparation. It’s about having the confidence to enjoy life’s biggest moments while staying ready for its surprises.

If you’re unsure where to begin or how to refine your plan, our team at Allegheny Financial Group is here to help.

We’ll work with you to design a personalized wealth management strategy that helps protect and grow your assets—no ghost stories required.

Financial planning doesn’t have to be spooky. With the right plan, you can summon confidence instead of chaos this Halloween season—and all year long.

Sources:

- https://newsroom.fidelity.com/pressreleases/fidelity-s-16th-annual-resolutions-study--americans-gearing-up-for-unexpected-financial-events-in-20/s/5613c543-fa52-4539-a690-a9d833773754

- Fidelity Investments® Releases 2024 Retiree Health Care Cost Estimate as Americans Seek Clarity Around Medicare Selection

- How Long Do Bear Markets Last? Here's What History Tells Investors. | The Motley Fool

- Guide to Retirement | J.P. Morgan Asset Management

The information included herein was obtained from sources which we believe reliable. This article is for informational purposes only, does not represent any specific investment, and should not be construed as investment or tax advice.

Author: MaryKate Tobin, CFP® | Allegheny Financial Group | October 2025

Allegheny Financial Group is an SEC Registered Investment Advisor.