Don't Let Liquidity Drain Your Wealth: Smart Financial Planning for Sustainable Growth

Market volatility at the start of this year has left many investors feeling uneasy. It’s natural to question whether your savings are working hard enough, or if it’s safer to hold onto cash. But when it comes to liquidity in financial planning, holding too much cash can actually slow your long-term financial growth.

In this article, we’ll explore how to balance liquidity with growth by understanding liquidity drag, how time horizon investing helps guide your decisions, and why emergency fund planning should be your first step. You’ll also learn how working with a financial advisor can help you align your cash strategy with your personal goals.

What is Liquidity in Financial Planning?

Liquidity refers to how easily an asset can be converted to cash without losing value and limiting the effects of market fluctuations on your savings. The most liquid forms of assets include your checking and savings accounts, as well as money market funds, where your funds are stable and readily accessible.

A common non-liquid asset is real estate. If you own a home or any type of physical property, these would not be the first place you would look to create cash you may need immediately. It takes time to find a willing buyer and finalize the sale, which could take place over multiple months. If you have a situation where you need cash, you most likely need it now, not in three months.

Understanding where liquidity fits into your plan depends on your specific goals, risk tolerance, and time horizon.

Why Time Horizon Matters in Wealth Strategy

Your time horizon is the estimated time when you will need access to money you are saving to fund a specific goal. This plays a vital role in how your money should be invested. Determining what those goals are and deciding on a time horizon is a great place to start.

To help simplify, we typically break this down into four categories:

- Emergency Reserves – funds you need immediate access to for unexpected needs

- Short-term Savings Time Horizon - less than five years

- Intermediate-term Savings Time Horizon – five to ten years

- Long-term Savings Time Horizon – Over ten years

Each of these time horizons calls for a different investment strategy. Shorter time horizons demand more liquidity and stability. Longer time horizons allow for greater exposure to growth opportunities that outpace inflation.

Emergency Fund Planning: Your First Line of Defense

A strong financial plan begins with emergency fund planning. This reserve is designed to protect you from the unexpected, like a sudden medical bill, job loss, or home repair. This helps avoid needing to dip into long-term savings and investments at the wrong time, reducing your long-term savings goals.

Your emergency cash should be kept in a stable investment like a high-yield savings account or money market fund, which provides both liquidity and a modest return. These tools help maintain purchasing power while minimizing exposure to short-term market volatility.

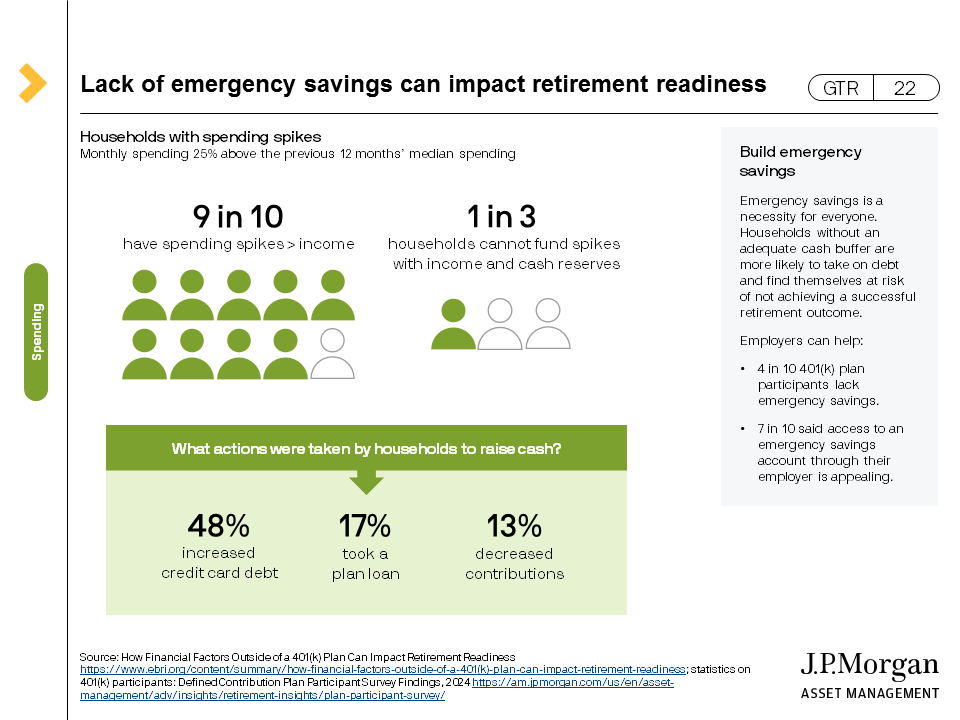

According to JP Morgan’s Guide to Retirement research, it shows that 9 in of 10 people experience a spending spike greater than their income in any given year. Unfortunately, 1 in 3 households cannot cover these sudden expenses with their income and cash reserves. Instead, they often resort to debt or sacrificing future goals.

Keeping 3 to 6 months of expenses in liquid reserves is a proven strategy for protecting your financial plan and giving you peace of mind.

These cash reserves can help preserve the money you have set aside for other goals. By having accessible cash always ready, you won’t need to take money from investments earmarked for other goals while the markets are down and potentially lose some of your initial savings. Emergency reserves are the perfect place to have liquidity as its job is safety.

The Risks of Holding Too Much Cash

Liquidity is critical, but too much can work against you. When you hold more cash than necessary for those short-term needs, you may cause your assets to suffer from liquidity drag, where uninvested funds lose value over time due to inflation.

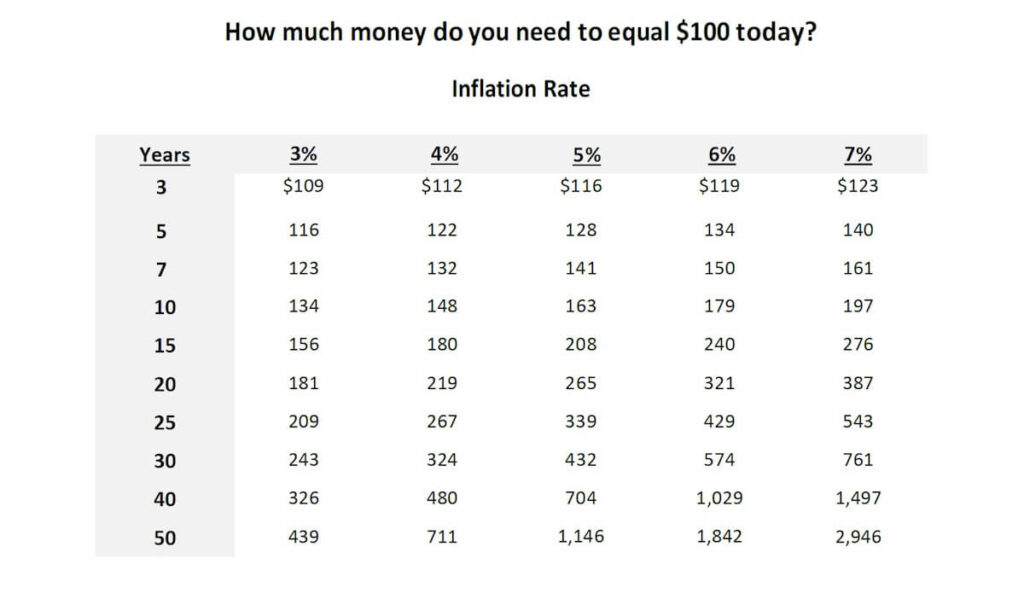

Take this example: According to the U.S Bureau of Labor Statistics CPI Inflation Calculator, you would need $1.25 today for something that costs $1.00 in April of 2020. The CPI Inflation Calculator is an interesting calculator to see how inflation has changed over many years.

Below is an excellent chart that we like to review with clients, showing how much you would need in future years to have the same buying power as $100 today depending on the time horizon and inflation rates.

The dollar you put away into savings 5 years ago can’t buy the same amount today that you could when you first saved that money.

If you’re holding cash in excess of what’s needed for emergencies or short-term goals, you’re likely sacrificing long-term wealth by not investing those excess funds. That’s why a balanced financial liquidity strategy is so important.

How to Avoid Liquidity Drag and Grow Wealth

As we’ve seen above, you can’t save your way to wealth due to the risk of inflation. Investing allows your money to work and grow over time, even amid market volatility. A well-crafted excess cash investment strategy is critical to fighting liquidity drag.

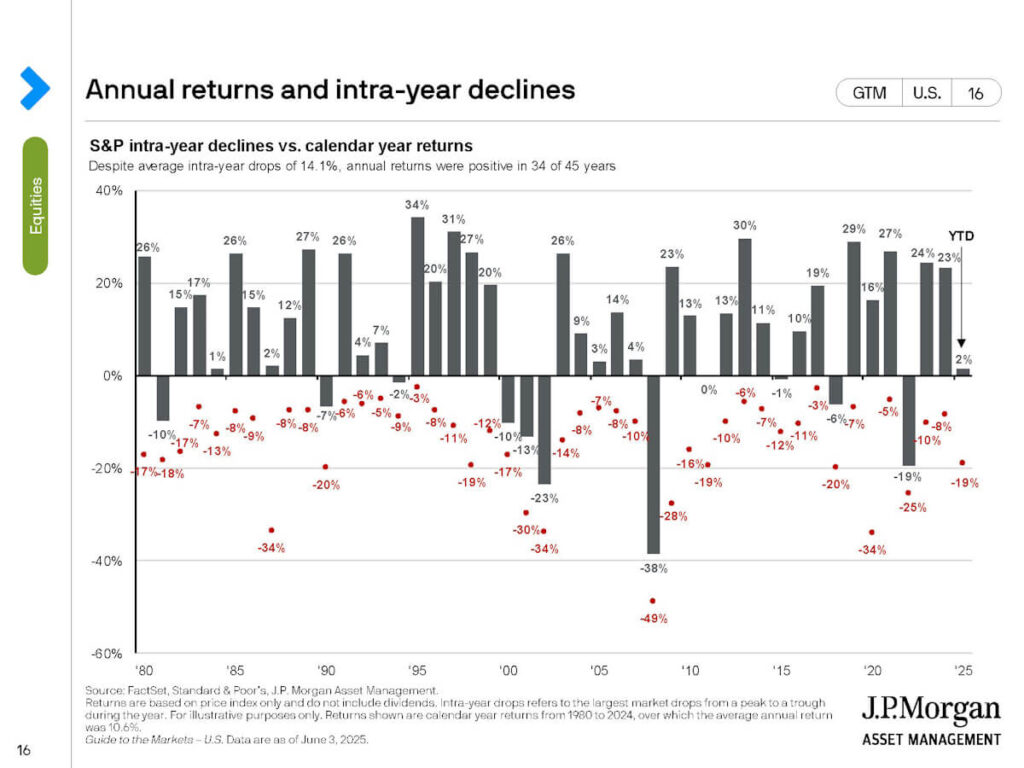

You may be thinking, with all of the market volatility, how does it make sense to invest my extra cash? Historical data offers reassurance. There have always been periods of time when the events of the world have impacted market performance, but outcomes are typically more optimistic than you may expect. In the chart below from J.P. Morgan, you can see they’ve tracked intra-year declines since 1980. It illustrates that since 1980, the S&P 500 has averaged a drop of 14.1% during the year, yet three out of 4 years still ended in gains overall. We can’t predict what will happen in the markets, but this shows that some bumpy times during the year do not mean it will be a fully negative year. Whether you’re saving for a home, college, or retirement, maintaining an investment strategy aligned with your time horizon gives your goals a fighting chance, even when markets dip.

Leveraging Proprietary Research to Stay the Course and Manage Risk

At Allegheny Financial Group, our approach to wealth management is grounded in both real-time analysis and proprietary financial research. One of our investment researchers explored the topic of volatility in a past article, The Current Economy: “It was the best of times, it was the worst of times…”. The article encouraged clients to remain committed to their long-term goals, even when the markets seemed unpredictable.

Historical data supports this view. For example, the J.P. Morgan chart referenced earlier shows that, despite temporary downturns, the last two years have had positive returns for the S&P 500. Staying focused on your goals’ time-horizon and avoiding knee-jerk reactions during market fluctuations allows you to benefit from compounding growth over time.

Part of avoiding liquidity drag is knowing how to find a mix of investments that can help you grow your wealth with the excess cash you have. That often means building a diversified portfolio tailored to your goals and comfort with risk. While the word risk can sound negative, in the context of investing, it refers to understanding the potential for ups and downs and choosing a strategy that lets you sleep at night. There are two things we can’t predict: when an unexpected expense may arise, and what the markets are going to do next. However, by combining historical data with forward-looking planning, you can make informed decisions and stay on track, even in uncertain times.

Investment Strategies for Different Time Horizons

A smart time horizon investing approach ensures your money is positioned to support your goals without taking on unnecessary risk. The further away the goal is, the more time your investments have to grow and recover from market dips.

Here’s an example of a diversification strategy:

| Time Horizon | Investment Approach | Liquidity Level |

| Emergency (0–1 years) | High-yield savings, money market funds | High |

| Short-Term (<5 years) | CDs, short-term bonds, conservative investments | Moderate |

| Intermediate (5–10 yrs) | Balanced mix of equities and fixed income | Medium |

| Long-Term (>10 years) | Diversified portfolio with equities and bonds | Medium |

For short-term savings, avoid aggressive investments. Market fluctuations can happen and may reduce what’s available when you need it. Intermediate-term goals can still be impacted by market fluctuations, but can support some risk, allowing for modest growth. Consider a mixture of some liquid assets, conservative assets, and equities. Long-term goals like retirement savings require the most growth and can handle more volatility over that longer time horizon. This makes them the ideal place to reduce cash and invest in a well-diversified portfolio with a mixture of equities and bonds, which can help you grow your savings to reach your goals.

What to do with excess cash?

Having excess cash beyond your emergency reserves is a good problem to have, but you need a clear plan. Without direction, leaving the extra savings in your checking or savings account could result in a slow loss of value to inflation.

Instead, consider your excess cash investment strategy in the context of your time horizons. For example, funds for a goal five years away shouldn’t be invested like retirement savings you won’t need for 30 years.

Ask yourself:

- What goal is this money for?

- When will I need to access it?

- How much risk am I comfortable taking?

Aligning your excess savings with a strategic, diversified investment approach helps ensure that your money works with your goals, not against them.

Working with a CERTIFIED FINANCIAL PLANNER® practitioner to help manage liquidity needs.

Creating a financial plan and finding the right balance between goals and liquidity can be overwhelming. That’s where working with a CERTIFIED FINANCIAL PLANNER® practitioner can provide structure, clarity, and confidence, especially if you’re navigating significant life changes or holding excess cash.

A financial advisor can guide you through:

- Getting Organized – Understand your assets, liabilities, and where your cash sits.

- Savings Evaluation – Identify where your current strategy may be too conservative or too aggressive based on your goals.

- Risk Tolerance Discovery – Determine how much market movement you’re emotionally and financially prepared for.

- Comprehensive Planning – Connect your liquidity strength with other goals like retirement, education, or legacy planning, to build a roadmap forward towards building wealth.

- Proper Investment Allocation – Build a portfolio that reflects your time horizons and your comfort with volatility for a well-diversified portfolio.

With expert guidance, you can move from uncertainty to action, knowing your liquidity strategy is working in harmony with your bigger financial picture.

Closing Thoughts: Turn Liquidity into a Growth Tool

Liquidity is a critical piece of your financial foundation, but too much can quietly slow your progress. By understanding liquidity drag, defining your time horizons, and aligning your cash with strategic investments, you can confidently pursue long-term growth while staying protected in the short term.

If you're unsure whether your current savings strategy is supporting your goals, consider reaching out to a financial advisor. With thoughtful planning, your money can become a tool for stability, opportunity, and sustainable wealth.

Author: Jen Koch, CFP®, CSS™ | Allegheny Financial Group | June 2025

The information included herein was obtained from sources which we believe reliable.

Allegheny Financial Group is an SEC Registered Investment Advisor.