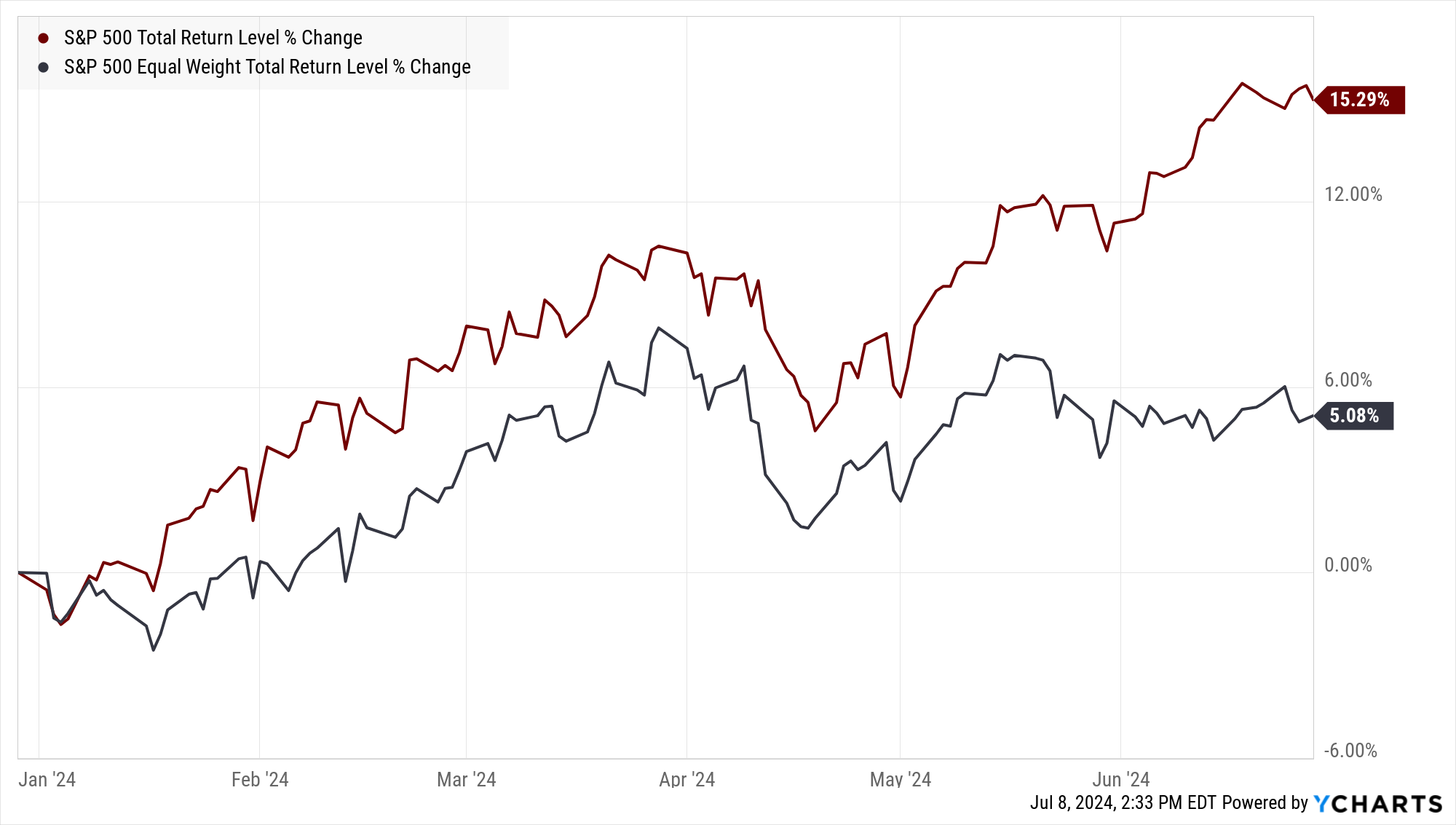

Key Takeaways from 2Q 2024

- The stock market has been dominated by the likes of Nvidia. However, diversification remains important, although it can be difficult when one area of the market is this strong.

- Cash is yielding 5%, but again, diversification in bond portfolios can provide better future returns despite cash being attractive right now.

It’s an artificial intelligence world, and everything else is just living in it. Over the past few quarters, commentaries could have been copied and pasted from one quarter to another, and it would have been tough to tell which quarter or period was being discussed. The story has gone, U.S. large-cap technology companies, led by Nvidia, post impressive returns; everything else has lagged.

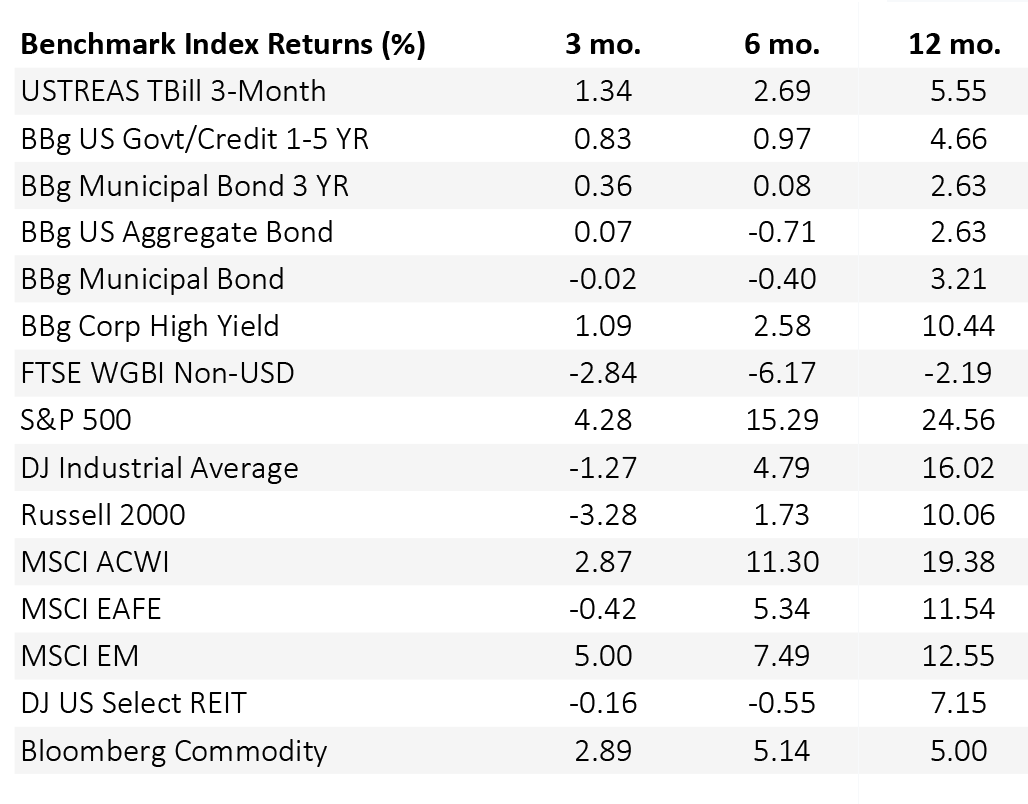

Second-quarter returns were an exaggerated example of large growth’s dispersion. Large cap growth, as measured by the Russell 1000 Growth Index, was by far the best performer, up over 8% for the three-month period. The Russell 2000 Growth Index, a proxy for small growth companies, returns fell almost 3% during the quarter. Value stocks declined between 2% and 3.7% for large and small companies, respectively. International stocks, led by emerging markets, ended the quarter positively, although still less than U.S. large-cap bellwethers.

Expanding our view to the first half of the year, international developed and emerging stocks, and U.S. mid and small companies are all up low to mid-single digits. Investors just seeing those returns, paired with bonds up slightly, on average, would be content with their portfolio’s six-month return. But then we introduce returns of the U.S. mega cap companies, and portfolio suddenly looks underwhelming.

Comparison of Equity Manager Styles

6 Months Ending 6/30/2024

The gap in performance between the best performers and everything else leads investors to question why they should own anything besides large cap technology. Before getting into why everything else is still an important allocation, let’s spend time on how drastic the performance between these top stocks and everything else has become.

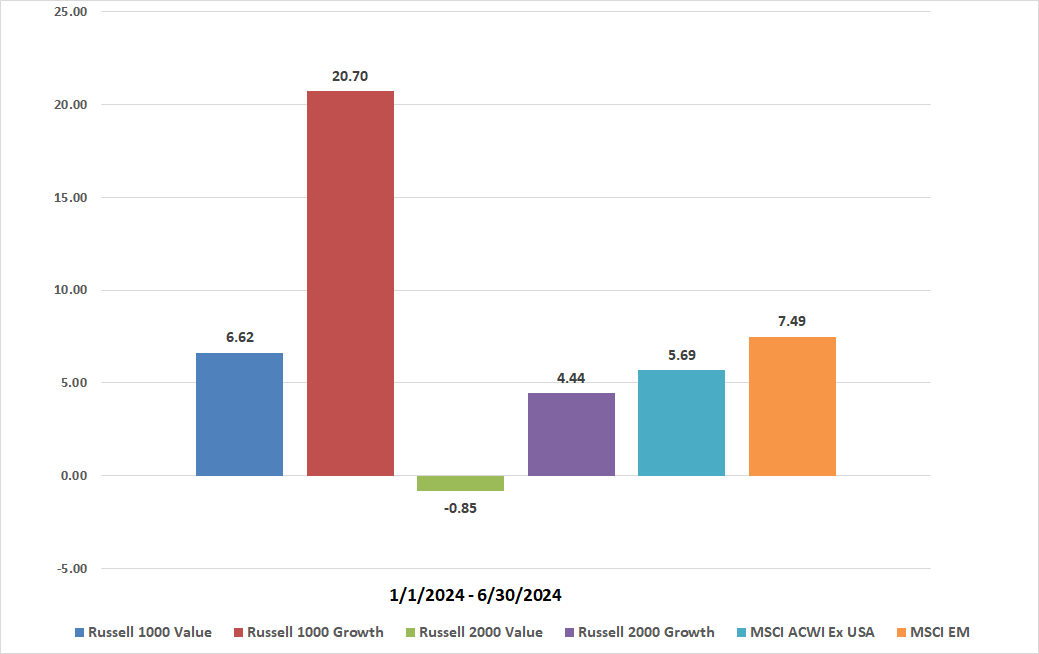

The top performer goes to Nvidia, which has risen by 150% so far this year and accounts for 30% of the S&P 500 Index’s return by itself. Add to that Alphabet, Microsoft, Meta, and Amazon, and you now have over half of the S&P 500’s 15% return in just those five stocks. The Magnificent Seven has become the “Fab Five” as even Apple and Tesla have not kept up with other top names. The S&P 500 Equal Weight Index is another way to see how much the top handful of companies are driving returns. The S&P 500 Index is a market cap-weighted index, meaning the bigger the company, the bigger its weight in the index.

The S&P 500 Equal Weight Index gives every company in the index the same weight, neutralizing the impact of the largest companies and showing us how all companies are performing, not just the largest ones. Through the first six months of the year, the Equal Weight Index is up 5%, compared to the S&P 500 Index, which is up 15%. According to Dow Jones, this 10% difference in returns is the widest margin since at least 1990, when data collection started.

S&P 500 Index vs. Equal Weighted Index

Comparing diversified portfolios to these top-performing stocks will most likely show disappointing returns. This leads some investors to ask: Why not just invest in the best-performing, biggest companies and ignore the underperforming areas? While there are many reasons not to go all-in on any one idea, the main reason is that we do not know which areas of the market will be best going forward. However, we can look back to the Tech Bubble as a worst-case scenario of buying an expensive stock, assuming it would continue to increase.

Cisco Systems is a prime example of a great company that is only a great investment if bought at the right price. Towards the end of the Tech Bubble, Cisco was the largest company, worth about $500 billion. When the Tech Bubble peaked, Cisco was down over 80% the following year. Today, it has a $190 billion valuation, never returning to its peak nearly 25 years ago. Cisco remains an important company, but not worth the premium it was trading during the exuberance of a technology-driven market.

This is not to say we are in a bubble, or that Nvidia is set up to become Cisco 2.0. Nvidia is a great company, and currently, there is no reason to question if it will maintain that status for the foreseeable future. The point is that betting heavily on arguably the most important company of that period would have been a terrible investment because it was too expensive. The more expensive a stock becomes, the greater expectations evolve, and even a minor disappointment in earnings can significantly impact the stock price. Instead of buying more Nvidia or any of the other top performing stocks, which most portfolios own, we want to take profits from those areas of portfolios and buy more of what has been overlooked but remains a great investment.

We remain diligent about not getting overly excited about any one investment. Although the largest companies have performed well over the past eighteen months, 2022 was very different story. At the halfway point of this year, so far the top performers of 2024 were the worst performers in 2022, down significantly more than the S&P 500 Index’s 18% decline.

Bonds

On the bond side of portfolios, the “cash is king” mantra has returned; cash is yielding 5% and has been one of the best-performing bond sectors over the past few years. So why do bond portfolios need to own anything except for cash?

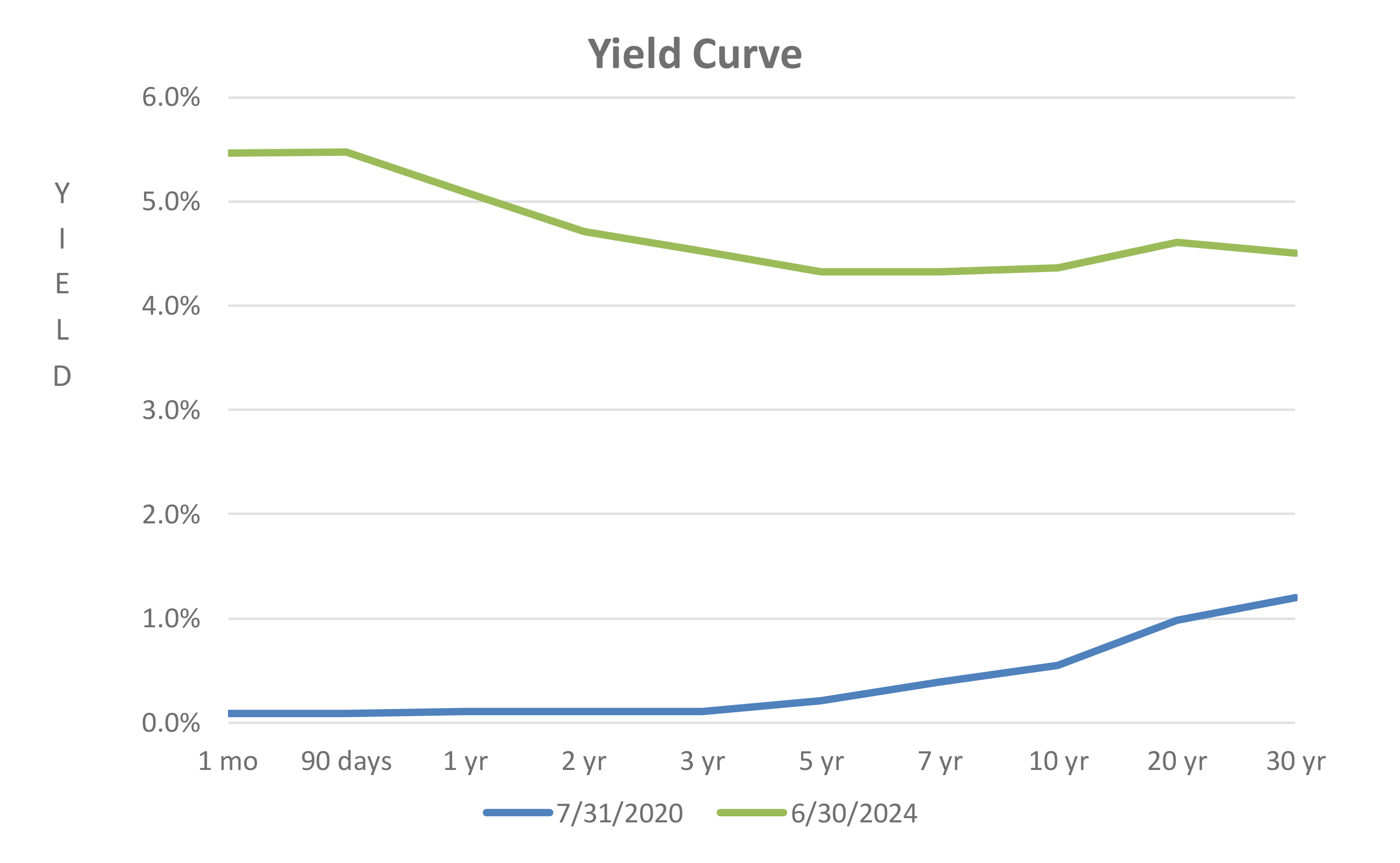

To establish why owning more than cash is essential, let’s return to the bond market of the decade prior to 2020 (or the prior four decades). Bonds were in a bull market from 1981 when the 10-year Treasury Bond peaked at a 15.8% yield, until the 10-year bond bottomed at a 0.55% yield in 2020. When yields fall, bond prices rise, making this multi-decade period one of impressive bond returns.

Fast forward to the 2010s, yields had been falling for 30 years, continuing to increase the price of bonds. However, the yield bonds were paying also fell. During the prior decade, the 10-year Treasury bond barely broke 4% in the early years and spent most of the time paying less than a 3% yield. Then, the COVID-19 pandemic hit, and the Federal Reserve cut short-term rates to 0%, while the market sent the 10-year Treasury to an all-time low of 0.55%. This means investors realized just about all they could out of bonds’ price appreciation, which also meant taking the income out of fixed income. So, when yields began to increase, there was no income to offset the price depreciation, leading to the worst year for the bond market in recorded history.

There is no doubt that the recent bond market has caused investors pain. Negative returns in the so-called safe area of the portfolio were not forecasted by very many. However, that pain has returned income to fixed income and set portfolios up for better expectations going forward.

Cash has been the best performer since the Fed started raising interest rates because there is no duration (i.e., the time until a bond matures) in cash. The only return associated with a cash investment is the income it pays. As the Fed increased rates, the income on cash increased at the same rate because there was no duration.

Any bond with a duration must adjust its price because the yield is fixed until it matures. For example, a bond was issued at $100 in 2020 with a 3% yield and matures in 2025. As the yield curve increased, new bonds were being issued with the same 2025 maturity but now pay a yield of 5%, making the 3% bond unattractive. In order to keep the market efficient, the 3% bond’s price must be adjusted to a lower price, such as $98. When the bonds mature in 2025, the total return of both will be 5%. The 5% bond will be in the form of income, the 3% bond will return 3% in income and 2% in price appreciation at a $98 sell price, and the investor will receive $100 at maturity.

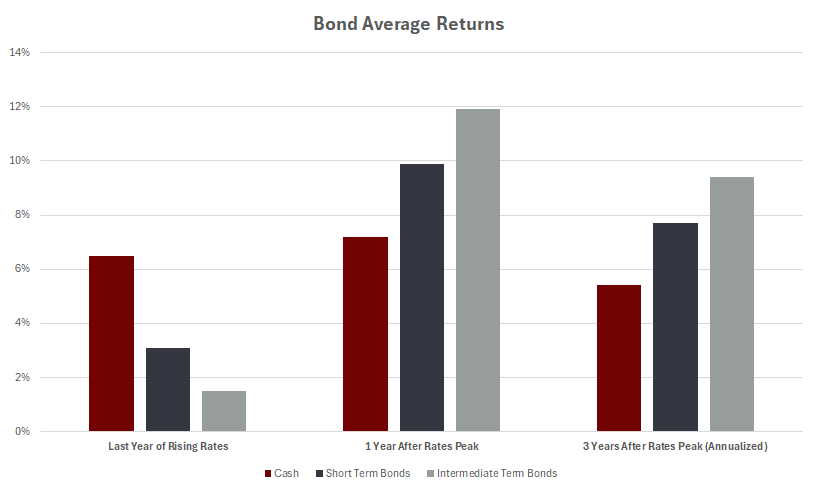

When the Fed starts to cut interest rates, bonds will react in the opposite direction. Cash’s yield will fall immediately, and prices on existing bonds will increase to compensate for the lower yield that newer bonds are offering. The chart below from PIMCO demonstrates this pattern. Cash returns will lead the way while rates are rising, especially towards the end of the rising rate cycle.

Source: PIMCO

Despite what prior returns have shown, this is the time to become more diversified in bond portfolios. Moving to all cash now is giving up potentially higher future returns because cash will not pay 5% forever Investing in longer-duration bonds now, can possibly lock in higher income for more years. For portfolios that currently have a larger weight to cash, consider reviewing the portfolio’s allocation and diversifying across fixed income sectors or varying durations to set your portfolio up for better future returns.